Customer Due Diligence FAQs

Your frequently asked CDD questions answered here

What is CDD? Why should I do it? And can someone just do it for me?

Customer Due Diligence (CDD) is the process of gathering personal information from your customer to assess their identity and level of potential risk for money laundering and financing of terrorism (ML/FT).

Working out who to identify and what information to collect can be quite confusing. So, we've put together this CDD FAQ page to help you find the answers you need.

Check them out below, and don't forget to download your copy of our quick guide on where businesses are commonly going wrong in their AML/CFT management.

Frequently asked CDD questions

Discover the answers to the most commonly-asked questions about customer due diligence, and get our top tips on how to manage it better.

When doing business with a customer you need to identity your clients, any beneficial owners of your client (for example, if the client is a company or trust), and/or anyone acting on behalf of your client (i.e., the person instructing you). You need to assess and record the nature and purpose of the business relationship with the client and the level of ML/FT risks they pose to your business. This is called AML Customer Due Diligence (CDD), internationally also known as Know Your Customer (KYC).

Your client can be:

- A trust

- A legal entity (e.g. a partnership or company)

- An individual

Once you have worked out the beneficial owners that need to be identified you will need to verify their legal name, date of birth, and proof of address.

You will also need to gather and record the nature and purpose of the business relationship with the client, for example how long the relationship is likely to last, and the type (size) and number of transactions you expect them to undertake.

The goal with CDD is to understand your client, monitor their transactions/activities, and ultimately detect suspicious activities.

In the event your client is deemed high risk (and for other circumstances prescribed by the legislation, for example in the event that your client is a trust or a politically exposed person), you will need to collect and verify information on the source of funds/source of wealth of your client.

CDD comes in three forms: standard, enhanced, and simplified.

- Standard CDD: Performed on the majority of clients, which are low and medium risk individuals, companies, and limited partnerships.

- Enhanced CDD: Performed on high-risk clients. The Act prescribes some categories of clients that require Enhanced CDD. Some examples are: trusts, politically exposed persons, and entities with nominee director/shareholder/partner relationships.

- Simplified CDD: Performed on listed companies, local authorities, Crown entities, government bodies and registered banks.

Ongoing CDD

Initial CDD is a moment-in-time snapshot of your client. There will be reasons to revisit CDD to check that it’s still up-to-date and correct, and this is called Ongoing CDD. You will be triggered to complete ongoing CDD based on factors like risk, a timed event, or a change in the business relationship. Your Compliance Programme should outline this.

Knowing your customer by gathering their identifying information means it’s easier to spot any potentially suspicious activity/transaction. Is this person who they say they are? How do you make sure that is the case?

It’s important to do AML Customer Due Diligence so you don’t inadvertently take part in legitimising or aiding a money launderer or the financing of terrorism. If you do not conduct thorough CDD to the levels in legislation and guidance, you may be required to undergo extensive remedial work by the Supervisor or be prosecuted under the AML/CFT Act.

Both in NZ and globally the Supervisors have prosecuted businesses and imposed large fines for poor AML processes, not money laundering per se. By doing AML right, businesses can avoid both the reputational damage and the enormous cost of legal proceedings, and importantly, help in the fight against money laundering.

CDD must be completed on clients, beneficial owners, and each person acting on behalf of the client. In order to perform CDD, you will need to collect information and verify it using independent and reliable sources (e.g. a passport to verify a person’s name and date of birth).

- For individuals: An individual is a person. You will need to gather their name, date of birth, proof of address, and verify this against supporting documents like a passport and utility bill.

- For non-individuals: For any other entity, for example a company, limited partnership or a trust, you will need the business name, business address, and registration number. You will need to verify the identity of any beneficial owners of the client. A beneficial owner is always a natural person, and to verify their identity you need to verify their name, date of birth, and proof of address against supporting documents.

With the right tools, CDD can take a matter of minutes. Learn the tools that will speed up the process:

- Digital document storage: rather than photocopying, filing, and storing physical copies of customer identity, make use of secure digital storage. Digital copies of required identification documents will be easier for your Compliance Officer to access, track, and manage. It is also more secure than filing cabinets in your office.

- AML Software: purpose-built AML/CFT software makes it easy to manage initial on boarding as well as enhanced, and ongoing CDD. With integrated eIV tools, digital document storage, verification reminders and notifications, AML software reduces CDD verification to a matter of minutes. Learn more here.

At AMLHUB, we believe CDD is quick, easy, and more cost-effective to do in-house. We encourage our customers to own the process as much as possible for a couple of reasons:

- You can't outsource your liability. Responsibility for correct CDD sits with your business alone, which is why each customer onboarded needs to be signed off by your Compliance team.

- Outsourcing is added cost on top of your fixed AML costs. When done correctly in-house, CDD takes just minutes to complete yourself.

However, there are situations where you may want to outsource. For example:

- When faced with complex structures that contain multiple layers of companies, trusts, and beneficial owners.

- When it is awkward for you to ask your client for source of funds / source of wealth.

- When you are pressed for time.

AMLHUB gives you the option to handle AML Customer Due Diligence yourself using easy tools and streamlined workflows. It also has an integrated Outsource option where, at the click of a button, you can send your CDD to our Outsource team who will do it all within your AMLHUB instance - giving you complete transparency and control.

A Beneficial Owner is always a natural person. A beneficial owner may be:

- A person who owns more than 25% of the customer.

- A person who has effective control of the customer (e.g. directors, trustee, or senior managers).

- The person on whose behalf the transaction is conducted.

Your customer's Source of Wealth is the origin of their entire body of assets. This information gives an indication of the amount of wealth your customer would be expected to have and a picture of how they acquired it.

Your customer's Source of Funds is more narrowly focused. It is the origin of the funds used for the transactions or activities that occur within the business relationship with you.

Please note: this material is provided as a reference only and does not constitute formal advice. AMLHUB takes no responsibility for decisions made based on this information. For any questions about AML/CFT law and compliance, get in touch with our Consulting Partners, AML Solutions.

9 common AML mistakes businesses make

mistakes businesses make

The AML Supervisors now have a low tolerance for mistakes in AML programmes, but businesses are consistently making the same ones every year.

In our quick guide we break down:

- What the 9 common AML/CFT mistakes are

- Why businesses are making them

- What you should do to avoid them

Get your free copy by filling out the form.

Download Quick Guide

See the most common mistakes businesses are making in their AML/CFT programme management, and how you can avoid making them.

Complete CDD in minutes with AMLHUB

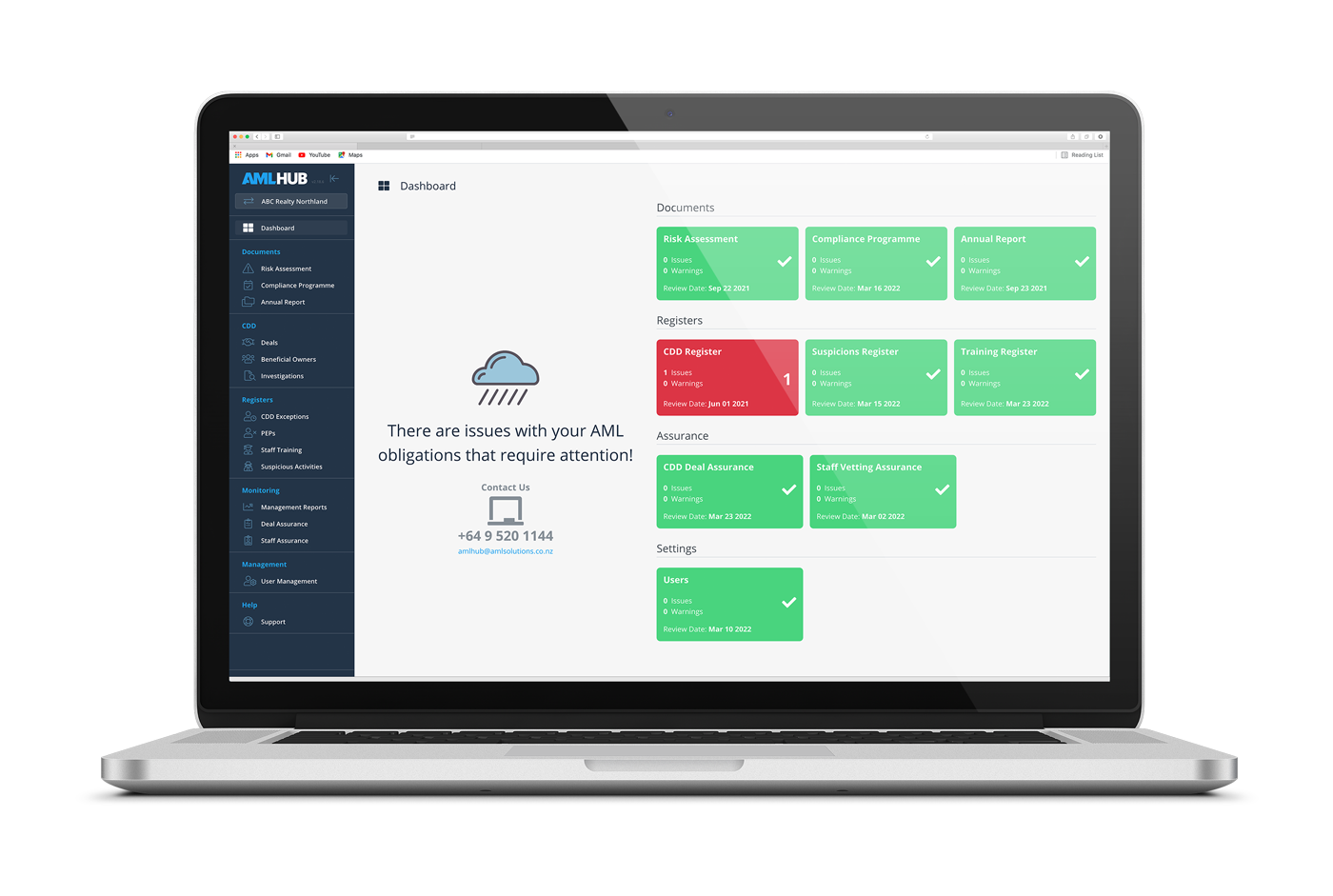

It’s now easier than ever to manage customer onboarding and CDD with AMLHUB.

AMLHUB is New Zealand’s only anti-money laundering software platform that helps you manage your entire customer onboarding process—fast.

With AMLHUB you can complete CDD in just minutes either in person via the app or remotely.

Easy two-way notifications allow frontline staff and the Compliance team to notify each other when work is ready for review, and when it gets complicated or you run out of time, simply outsource at the click of a button.

Maximise your compliance while driving down the risk, time, and money spent on AML. Get your demo of AMLHUB below!