As sponsor of the AML SUMMIT, we joined 400+ AML/CFT professionals live and online at the two-day conference.

Every year the AML Summit brings together New Zealand's AML/CFT professionals, experts, and industry leaders. We were there in the thick of it, and have pulled together some of the highlights from the two days. See our recap of the event, below.

A fascinating look into the correlation between corruption and money laundering, and the lessons that can be applied to business practices.

In the first AML Summit keynote speech, Professor John Hopkins and Doctor Chat Nguyen (University of Canterbury) discuss how corruption and money laundering are inextricably linked, with the proceeds of corruption often laundered through various typologies by corrupt officials and individuals. They present their latest research on the correlation between the two, and discuss how the tools established to fight money laundering can also help in exposing and limiting corruption.

Detective Inspector Christiaan Barnard (FIU) gives an overview into the impact of New Zealand sanctions on Russia.

As the second keynote speaker of the AML Summit, Detective Inspector Christiaan Barnard takes us through New Zealand's sanctions against Russia, starting with an outline of the history of Oligarchs and their rise to power, and how this provides context to New Zealand's sanctions on Russia. Detective Barnard talks through New Zealand business's resulting obligations, what high-risk typologies look like in our borders, and gives his thoughts on what businesses should focus on to effectively detect sanctions breaches.

Police dog, Arc, getting ready to show attendees how it's done.

An AML Summit classic, the NZ Police give a demonstration on how easily their trained dogs can detect hidden cash, with Police dog, Arc, finding shredded samples of banknotes hidden within volunteers' bags.

Dylan Gallagher (Manager, AML Solutions) gives an entertaining look into best-practice AML governance.

What does the Board need from their AMLCO and what does an AMLCO need from the Board in order to run a compliant organisation? AML Solutions Manager, Dylan Gallagher, uses several entertaining analogies to discuss the importance of creating a culture of compliance by setting the tone from the top, and how this can practically be done from both a Compliance function perspective and that of the Senior Managers.

A discussion on how smart technology can reduce the burden of AML compliance, and where AML tech is heading in the near future.

Technology is the path to making the right thing to do, the easiest thing to do. Andrew Freeman-Greene (AMLHUB Product Strategy & Development) takes part in a lively panel discussion on how technology can reduce the burden of AML compliance. The panelists look at where AML/CFT technology is heading in the future, particularly around reducing cost of compliance and simplifying the workflow through automation and education. Current and upcoming developments in AML/CFT technology will give businesses the advantages of reducing human error, automating AML/CFT processes at scale, and make it easier to manage AML/CFT obligations.

The New Zealand AML Supervisors provide their valuable updates.

Representatives from the three Supervisors (Andrew Hill, DIA; Brandt Botha, FMA; Damian Henry, RBNZ) give an overview of the activities their organisations have undertaken in the last year, with commentary on the areas of AML/CFT that reporting entities are still struggling with, and how they're typically going wrong. The Supervisors then give delegates a look into what will be the focus for the coming year, with a reminder on the importance of getting AML/CFT right.

A practical workshop on Enhanced Due Diligence.

I was privileged to lead a workshop on how to identify beneficial owners and conduct Enhanced Due Diligence. When faced with complicated structures it can be difficult to pinpoint who the people are that you have to conduct due diligence on. Getting it wrong means you waste time collecting information from people you don't have to, or fail to capture the people you should, making your business non-compliant. Using the 25% rule and following a simple mapping exercise, I demonstrate how to easily find the people you need to do due diligence on, and how to disregard those that are not relevant to your transaction.

Want to look forward to your next audit? The best advice is to create a culture of compliance.

Karty Mayne (Founder, Rosewill Consulting), delivers a workshop on the importance of creating a culture of compliance, and how Compliance Officers can go about creating or enhancing one. A compliance culture builds on the values and mission of a company, and buy-in is led by Senior Management. The challenge Compliance Officers face is making Senior Management understand the threats to, and vulnerabilities of the business, and turning them into champions of compliance so that the rest of the business follows suit. In the workshop, Karty gives practical ideas and strategies to overcome these challenges, to make AML/CFT a "business as usual" activity that spans the entire company.

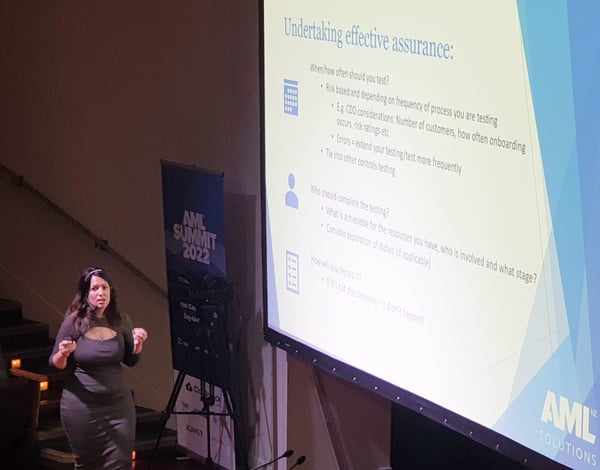

As Tijana Misur explains, it's easy to make mistakes you simply don't see.

Internal assurance is a great tool in the AML/CFT belt for gaining and maintaining compliance, especially when it comes to catching any mistakes you're making before your auditor does. Tijana Misur (Head of Delivery, AML Solutions) leads a workshop discussing why internal assurance is important to Compliance Officers, how internal assurance can help auditors get their external audits done faster, and how Compliance Officers can be most effective at managing the assurance process.

Audits can be a smooth process if you nail these common problems that keep happening.

Drawing on his experience as an auditor, Royden McGee (Head of Compliance, Strategi), discusses the common issues auditors encounter, and the actions Compliance teams can take now to improve the result of their future audits. Focusing on the four key areas of an audit, Royden gives listeners practical advice that ranges from the importance of nailing AML basics first, to evaluating your auditor as much as they evaluate you, to making AML relatable to people in your business in order to maximise uptake.

All AML Summit presentations and workshops are now available on-demand until the end of the year. See the latest AML/CFT insights, strategies, and thought leadership by purchasing your access below.

As sponsor of the AML SUMMIT, we joined 400+ AML/CFT professionals live and online at the two-day conference.

If the time for your AML audit is rapidly approaching, the most important question at the forefront of your mind should be: who will be my AML auditor?