What is AML/CFT and why do businesses need to comply?

AML/CFT is an acronym that’s short for Anti-Money Laundering and Countering the Financing of Terrorism. In New Zealand it also refers to the AML/CFT Act 2009, and the corresponding obligations that businesses and individuals have, which are put in place to detect and deter money laundering.

When asking, "What is AML/CFT?" the answer to this question is complex, with many parts to consider. The AMLHUB team have put together this FAQ page to help you find the answers you need.

Explore our FAQs below, and download your copy of businesses' most common AML/CFT mistakes.

Frequently asked AML/CFT questions

Below you will find answers to the most commonly-asked questions about anti-money laundering, and get our top tips on managing your AML compliance. Discover what AML/CFT is, how money is laundered, what the laws are, and more.

Money laundering is the way in which criminals take “dirty” money obtained through illegal activities, and “clean” it by running it through legitimate channels to obscure its origins.

There are many sophisticated ways to layer the funds through multiple channels. For example, putting $1 million cash into your bank account is easily detected. But using different financial products and assets via legitimate businesses can disguise the origin of the money and make it easier for criminals to access.

Money laundering and the financing of terrorism is a big problem in New Zealand, with an estimated $1 billion laundered every year. Globally, this figure is estimated to be $4 trillion.

There are a variety of ways money can be laundered, ranging from the simple (such as business fronts) to the very complex (multi-country money transfers via shell corporations). The methods of money laundering are seemingly limited only by criminal imagination.

There are three typical stages to the money laundering process: placement, layering, and integration.

- Placement: this is when dirty money is entered into the financial system, either locally or abroad. For example, buying foreign money through a currency exchange, or purchasing a large asset like property.

- Layering: at this stage, the money is “washed” through several transactions to obscure the trail further and create the impression that it’s legitimate, typically across country lines. This could be in the form of wire transfers or making payments between shell companies. The point at this stage is to keep the money moving, take advantage of bureaucratic delays and legal loopholes, and create a difficult trail to follow.

- Integration: the now “cleaned” money is integrated back into the system and can be accessed and spent on whatever they like. Since it appears to have come from a legitimate source, there is no suspicion.

- Read the AML/CFT legislation, regulations, and guidance here.

- Any business that conducts activities in accordance with the Act is designated as a Reporting Entity and is under an obligation to comply with the Act. This captures many businesses and includes types of sectors like banks, FX dealers, fund managers, lawyers, accountants, and real estate.

- The Act is overseen by three Supervisors: the Department of Internal Affairs, the Reserve Bank of New Zealand, and the Financial Markets Authority.

- The AML/CFT Act comes with both criminal and civil penalties which is meant to enforce the legislation, and businesses need to be rigorous in complying with its obligations. Businesses and individuals that do not meet their AML obligations could be faced with the following:

- Private warning

The Supervisors will conduct reviews and where the business is non-compliant, may issue a warning to the Company Directors. The Supervisor will then follow up to check if you’ve implemented required changes or remedial actions. - Public warning

The Supervisors issue a public statement highlighting where the business is non-compliant. Public warnings generate much media interest and cause significant damage to brand reputation (see an example of a DIA formal warning here).

- Private warning

-

Fines and prosecution

Under civil liability, individuals can face fines of up to $200,00 while body corporate or partnerships can face up to $2 million.[3]

Under sections 91 to 97 of the Act, individuals can be hit with fines of up to $300,000 and up to two years’ imprisonment. Body corporates or partnerships can receive fines of up to $5 million.[4] - For any questions or advice about the AML/CFT legislation and guidance, we recommend you get in touch with AML Solutions.

[3] https://www.legislation.govt.nz/act/public/2009/0035/latest/DLM2140968.html

[4] https://www.legislation.govt.nz/act/public/2009/0035/latest/DLM2140981.html

The AML/CFT Act and its obligations exist to help businesses detect and deter money laundering and the financing of terrorism.

Money laundering is the result of harmful activities such as drug smuggling, bribery, corruption, human trafficking, and the financing of terrorism involves the funding of terrorist activities that are harmful to society.

Businesses that fall under the Act are those that perform activities that can be used by money launderers and terrorist financiers to funnel and hide money. So, New Zealand's AML/CFT laws place obligations on these businesses and their associated individuals to stop money laundering activities from taking place.

By cutting off the business channels through which illicit funds can be washed and returned to the criminals, the AML/CFT laws and obligations ensure criminals don’t profit from their harmful activities.

A comprehensive AML/CFT programme has several parts and multiple obligations for businesses and individuals to fulfil. We've provided an overview below, and recommend you consult with AML Solutions for further detail and information.

Businesses must:

- Appoint an AML/CFT compliance officer to administer and maintain the AML/CFT program. This is a designated employee (or another person) who reports to a senior manager.

- Develop and maintain a written Risk Assessment that assesses the risks the business may reasonably expect to face (much like a fast-food restaurant’s Health and Safety policy). Risk Assessments should be reviewed on an annual basis.

- Develop and implement a risk-based AML/CFT Programme. This should also be reassessed on a regular basis.

- Comply with the CDD requirements, i.e. performing simplified, standard, enhanced CDD, ongoing CDD, and account monitoring.

- Monitor and record suspicious activity and file reports with the Financial Intelligence Unit.

- Monitor transactions and submit prescribed transaction reports to the Financial Intelligence Unit.

- Train on AML/CFT matters and vet senior managers, the AML/CFT Compliance Officer and any staff engaged in AML/CFT duties.

- File an annual report with the Supervisor every year by 31 August.

- Get an independent audit of the business risk assessment and AML/CFT programme every three years.

- Demonstrate you’ve done all of the above through record-keeping and updates.

See how AMLHUB helps you manage all these obligations easily.

- Make sure your AML/CFT activities are in line with what’s written in your Compliance Programme, as that is what auditors and the Supervisors will assess you against.

- Write everything down. You need proof you fulfilled each part of your AML/CFT obligations, from training to vetting to why you didn’t do CDD on someone. As far as auditors and Supervisors are concerned, if it’s not written down, there’s no proof it happened.

- If you rely on someone else to complete your CDD, make sure you check and verify their work. Liability stays with your business, so if they make a mistake, or have poor process, the responsibility still falls to you.

- Conduct Assurance periodically either internally, or by using a third party (for objectivity). Use it as an opportunity to check if you're on the right track with your AML/CFT management, or if you potentially need to tighten up your compliance processes.

Customer Due Diligence (CDD) is when you identify an individual. For example, when a person/s owns a property, as opposed to a trust or company owning the property.

Enhanced Due Diligence (EDD) is when a property is owned by a company and/or trust. If this is the case, additional requirements such as source of funds will apply.

You need to prove who the people involved in your transaction are and where they live.

This requires a valid identity document and proof of address.

Best option: a signed passport and government-issued document with their name and address on it that is less than 12 months old (e.g. a rates bill).

Alternative option: a current driver licence with a secondary form of ID (e.g. bank card), plus proof of address.

Why is this important?

Nature and Purpose is about establishing your expected relationship with your client.

This is especially important if you plan on having an ongoing relationship with them, as it sets the period for which your AML applies, and can also help you spot anything outside the norm.

For example, in working with a vendor selling a property, you set the duration of the relationship as one year and the number of properties expected to be sold as one. However, if eight months into the relationship they come back to list another property, you would need to complete AML again.

We strongly recommend using the latest technology to simplify the AML management process and save your business time.

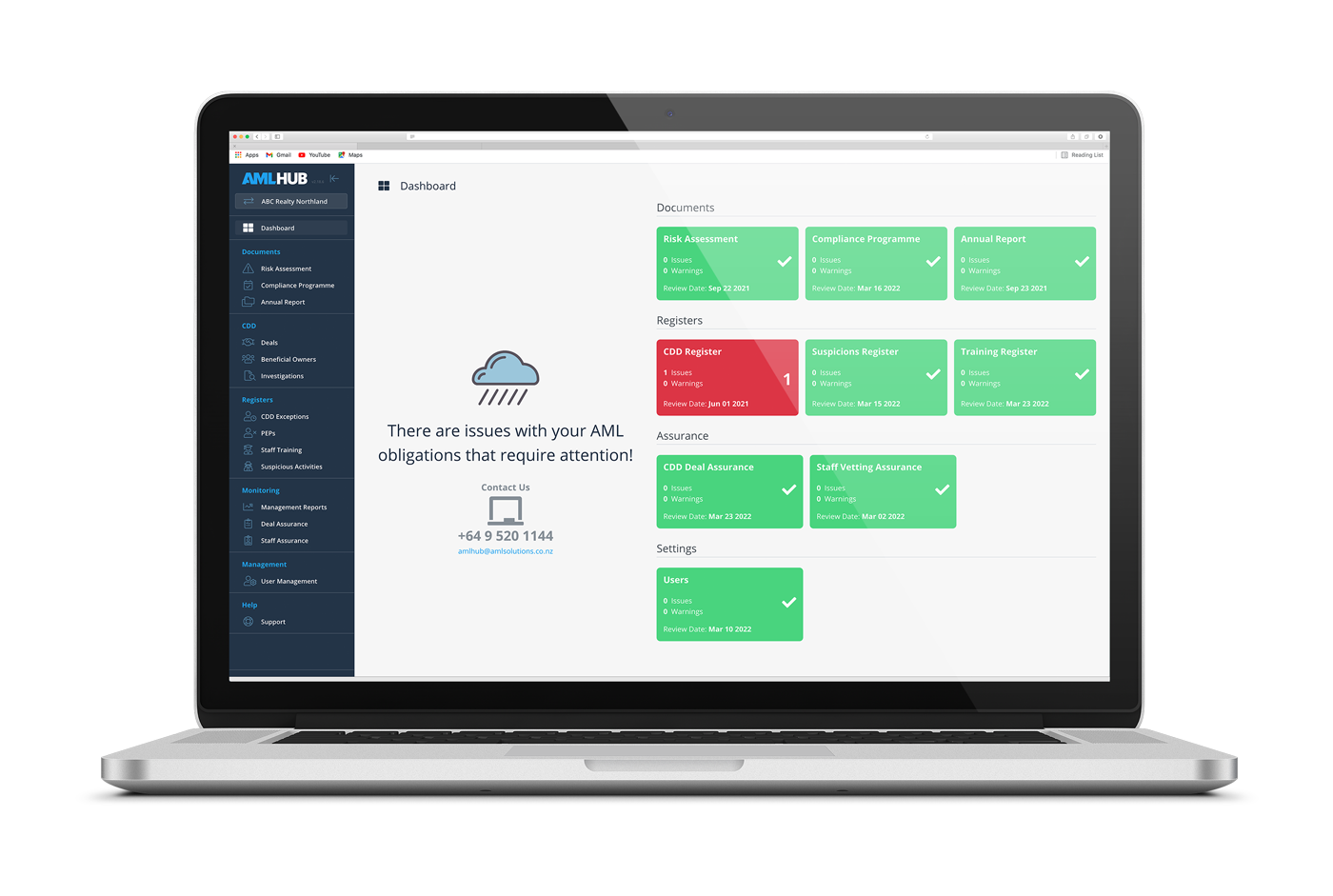

- AML Software: purpose-built AML/CFT software makes it easy to manage all the obligations outlined in the AML/CFT Act. AMLHUB is New Zealand's only end-to-end AML/CFT platform designed to do this. With integrated eIV tools (including RealMe), digital document storage, verification reminders and notifications, AML software reduces your daily AML management to minutes rather than hours, while ensuring you achieve maximum compliance and total transparency.

- Digital document storage: rather than photocopying, filing, and storing physical copies of customer identity, make use of secure digital storage. It is easier for your Compliance Officer to access, track, and manage, and is more secure than filing cabinets in your office. AMLHUB operates 100% in the cloud, allowing you to access it from anywhere.

Learn more about AMLHUB here.

Please note: this material is provided as a reference only and does not constitute formal advice. AMLHUB takes no responsibility for decisions made based on this information. For any questions about AML/CFT law and compliance, get in touch with our Consulting Partners, AML Solutions.

9 common AML mistakes businesses make

mistakes businesses make

The AML Supervisors have a low tolerance for mistakes in AML programmes, but businesses consistently make the same mistakes every year.

In our quick guide we break down:

- The 9 most common AML/CFT mistakes

- Why businesses are making them

- What you should do to avoid them

Get your free copy by filling out the form.

Download the Quick Guide

Manage your AML/CFT obligations seamlessly with AMLHUB

Now that you have an overview of what AML/CFT is, ensure you manage your obligations correctly with the AMLHUB.

AMLHUB is New Zealand’s leading anti-money laundering software platform that centralises and simplifies your AML/CFT workflows in one cloud-based location.

- No more juggling multiple spreadsheets and documents.

- Significantly reduce time spent on AML admin.

- Perfect for industries such as law, accounting, finance, and real estate.

- Built by NZ's leading AML experts.

Discover how AMLHUB can help you better manage your AML/CFT obligations. Request your demo below.